The Impact of Natural Disasters on Insurance Rates

Natural disasters have become increasingly frequent and severe, posing significant challenges not only to affected communities but also to the insurance industry. These catastrophic events, including hurricanes, earthquakes, wildfires, floods, and tornadoes, can cause widespread devastation, leading to substantial financial losses. As a result, insurance companies must adjust their rates to manage the heightened risk, which directly impacts policyholders. In this article, we will explore how natural disasters influence insurance rates, the factors contributing to these changes, and strategies to manage rising insurance premiums.

Understanding the Relationship Between Natural Disasters and Insurance Rates

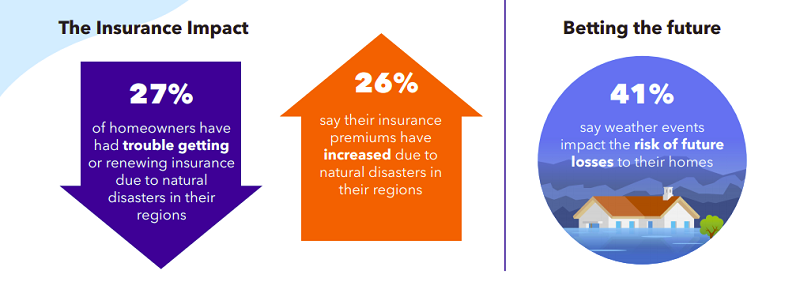

Natural disasters can cause massive property damage, leading to a surge in insurance claims. Insurance companies must pay out substantial sums to cover these claims, which can strain their financial resources. To mitigate this risk, insurers often raise premiums in areas prone to natural disasters. This adjustment helps them maintain solvency and continue providing coverage to policyholders.

For example, coastal regions frequently hit by hurricanes may experience higher home insurance rates. Similarly, areas prone to wildfires, such as California, might see increased premiums for property insurance. These rate hikes reflect the increased likelihood of claims due to natural disasters, ensuring that insurers can cover potential losses.

Factors Influencing Insurance Rate Increases

Several factors contribute to the rise in insurance rates due to natural disasters. Understanding these factors can help policyholders comprehend why their premiums are increasing and what they can do to manage costs.

-

Frequency and Severity of Disasters The frequency and severity of natural disasters directly impact insurance rates. More frequent and intense disasters lead to higher claims, prompting insurers to raise premiums to cover potential losses. Climate change has played a significant role in increasing the frequency and severity of events such as hurricanes and wildfires, contributing to higher insurance costs.

-

Reinsurance Costs Insurance companies often purchase reinsurance to protect themselves from massive losses due to catastrophic events. Reinsurance is essentially insurance for insurers. When the costs of reinsurance rise, typically after a series of significant disasters, insurers pass these costs onto policyholders in the form of higher premiums.

-

Geographic Location The geographic location of a property plays a crucial role in determining insurance rates. Areas with a history of natural disasters or those deemed high-risk zones will see higher premiums. For instance, properties in flood-prone areas or regions with a high likelihood of earthquakes will face steeper insurance costs.

-

Building Codes and Construction Quality Properties built to withstand natural disasters tend to have lower insurance rates. Building codes and construction quality are essential in reducing the risk of damage. Homes and buildings that meet stringent construction standards are more likely to survive disasters, resulting in lower insurance claims and, consequently, lower premiums.

-

Claim History A property’s claim history can influence insurance rates. Properties with a history of frequent claims due to natural disasters may be seen as higher risk, leading to increased premiums. Insurers consider the likelihood of future claims when determining rates.

Strategies to Manage Rising Insurance Costs

While policyholders cannot control natural disasters, they can take steps to manage rising insurance costs. Here are some strategies to consider:

-

Mitigate Risk Homeowners can take measures to reduce the risk of damage from natural disasters. This includes reinforcing roofs, installing storm shutters, elevating homes in flood-prone areas, and creating defensible space around properties in wildfire-prone regions. By reducing the risk, policyholders may qualify for discounts on their insurance premiums.

-

Shop Around for Insurance It’s essential to compare insurance quotes from different providers. Rates can vary significantly between insurers, and shopping around can help policyholders find the best coverage at the most competitive price.

-

Bundle Insurance Policies Many insurance companies offer discounts to policyholders who bundle multiple policies, such as home and auto insurance. Bundling can result in significant savings on premiums.

-

Increase Deductibles Raising the deductible—the amount a policyholder pays out of pocket before insurance coverage kicks in—can lower premiums. However, it’s crucial to ensure that the deductible amount is affordable in the event of a claim.

-

Review Coverage Regularly Policyholders should review their insurance coverage regularly to ensure they have adequate protection without overpaying. It’s essential to update policies to reflect any changes in the property, such as renovations or additions.

-

Take Advantage of Discounts Many insurers offer discounts for various reasons, such as installing security systems, being a loyal customer, or having a good credit score. Policyholders should inquire about available discounts and take advantage of them to reduce premiums.

The Role of Government and Policy in Managing Insurance Rates

Government policies and regulations play a significant role in managing insurance rates in the face of natural disasters. In some regions, government programs provide insurance coverage for high-risk areas where private insurers may be reluctant to offer policies. For example, the National Flood Insurance Program (NFIP) in the United States provides flood insurance to property owners in flood-prone areas.

Additionally, government initiatives aimed at disaster mitigation and preparedness can help reduce the impact of natural disasters and, consequently, insurance rates. Investments in infrastructure improvements, early warning systems, and community education programs can enhance resilience and lower the risk of damage.

The Future of Insurance in a Changing Climate

As climate change continues to influence the frequency and severity of natural disasters, the insurance industry must adapt to these evolving risks. Insurers are increasingly using advanced modeling techniques to assess risk more accurately and set premiums accordingly. This includes incorporating climate projections and historical data to predict future disaster scenarios.

Furthermore, the insurance industry is likely to see innovations in coverage options and risk-sharing mechanisms. For example, parametric insurance, which pays out a predetermined amount based on the magnitude of a disaster rather than the actual damage incurred, is gaining popularity. This type of insurance can provide quicker payouts and reduce administrative costs.

Conclusion

Natural disasters significantly impact insurance rates, leading to higher premiums for policyholders in affected areas. Understanding the factors contributing to these rate increases and implementing strategies to manage costs can help homeowners and businesses navigate the financial challenges posed by natural disasters. As the frequency and severity of these events continue to rise due to climate change, the insurance industry must innovate and adapt to ensure that coverage remains accessible and affordable. By mitigating risks, shopping for competitive rates, and taking advantage of available discounts, policyholders can better manage their insurance costs in an increasingly uncertain world.